RIMCA is dedicated to serving asset owners, financial institutions, professional investment managers, individual investors, and government and quasi-government institutions.

Our key services include:

Forensics-Based Actuarial Consulting

We see every complex risk and investment management problem for our clients as requiring an investigative approach to understanding what the real root causes of the problems could be. We do not believe in a one-size-fits-all approach. Our clients’ needs are as varied and diverse as the clients themselves. In our world, there are no generic solutions. We seek to speak to the heart of the problem – and only then are we able to deploy our technical expertise and know-how to develop uniquely tailor-made solutions.

Customised Investment Solutions

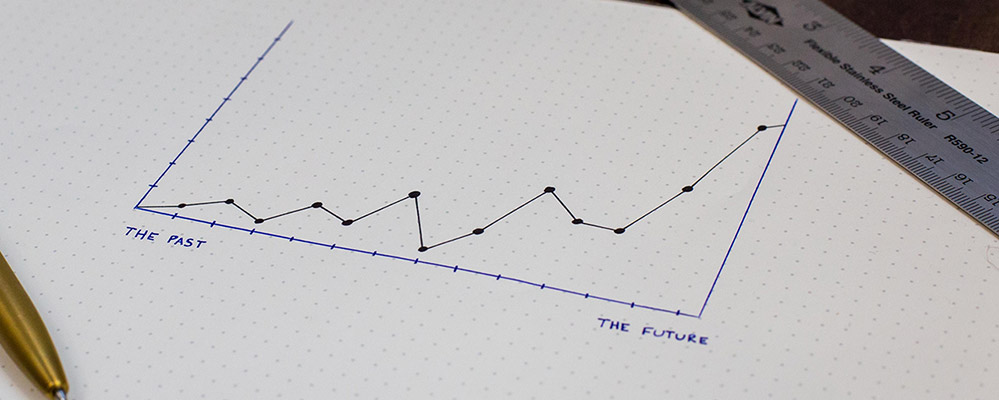

Every investment decision is a risk management decision. We believe, risk is a choice and not a fate – the choices that our clients dare to take, reflective of their willingness to forego short term comfort, is ultimately, what determines how comfortably they retire. We take a deep dive into understanding our clients’ liabilities and investment goals before customizing an investment strategy that most effectively achieve their objectives. In crafting our investment solutions we take a statistically quantitative and fundamentally theme-based multi-managed portfolio modelling approach using technologically robust and disciplined risk-focused investment management processes.

Enterprise Risk Management

All financial institutions are faced with risks that challenge their business. Astute firms have embraced the deployment of best practices and infrastructure to address the strategic, financial, operational, and hazard risks that they face. We partner with our clients to help them identify, quantify, manage and mitigate any such risks.

Actuarial Peer-Review Work

Our forensics-based actuarial approach puts us in good stead to specialize in peer reviewing work of fellow actuaries. This, we do, either in fulfillment of a regulatory requirement or only as part of a good standard industry practice by the hiring primary actuaries. Working closely with the teams of primary actuaries, we bring forth a fresh perspective and independent view-point adding on, and building upon, their value-add for the ultimate benefit of our mutual client.

Our focus on peer-review work alone means we work with many actuaries from different backgrounds and different expertise. That broad base of engagements and relationships gives us an edge and make us such an invaluable partner to all the actuaries who bring us in to peer-review their work. Whether we are hired by the client or by the primary actuaries we maintain an arm’s length relationship with the actuarial teams and our commitment is to provide an independent view point to the end client in a professional manner in line with professional guidelines and standards.